option to tax 20 years

You should keep your option to tax records for longer than 6 years. You can revoke your option to tax after 20 years by completing a form VAT 1614J.

Revoking Vat Option To Tax Elections Taxation

Each payment is supposed to be 5.

. If the annuity option is selected the winner is guaranteed to receive 30 graduated payments over 29 years. Can I opt to tax residential properties. The option will automatically lapse if no interest is held on the property for over.

If the call goes unexercised say MSFT trades at 48 at expiration Taylor will realize a short-term capital gain of 095 on their option even though the option was held for. 20 years have passed since the option to tax was made. Once a decision is made it usually applies for 20 years and can usually only be revoked if the building or land has been leased out as exempt for tax in the past.

Essentially speaking an option to tax lasts indefinitely but there is then the option to revoke it after 20 years. The option will automatically lapse if no interest is held on the property for over six years. If the winner were to go with the lump sum 1878 million would be withheld for federal.

An important feature of the option to tax regulations is that they apply to a property for a 20-year period once an election has been made by a business. Therefore the signNow web application is a must-have for completing and signing revoke an option to tax after 20 years have passed gov on the go. Before you can revoke the option to tax without having to obtain prior permission from HMRC you have to fulfil.

Section 1256 options are always taxed as follows. The option can be revoked 20 years after it was made. VAT1614J - revoking an option to tax after 20 years Use form VAT1614J to revoke an option to tax land andor buildings for VAT purposes after 20 years.

The annuity allows you to collect your winnings in 30 payments over 29 years but those payments are not divided into 30 even chunks. An option to tax cannot normally be revoked until at least 20 years have passed see section 8. 40 of the gain or loss is taxed at the short-term capital tax.

Where the property has previously been leased out as exempt. Once made an option to tax can only be revoked in limited circumstances or it remains in place for 20 years. An important feature of the option to tax regulations is that they apply to a property for a 20-year period once an election has been made by a business.

VAT1614J Page 1 HMRC 0520 Opting to tax land and buildings. The annual payments increase by 5 until the 30th and final payment. In order to revoke an option you must.

If youre not able to pay the. The cash option for this jackpot is 7824 million just under half the annuitized value. Even then it would require.

An option to tax election lasts for 20 years once made by a business so it should only be made after all relevant issues have been considered If you asked 100 accountants to. Revoking an option to tax after 20 years. The option to tax allows a business to charge VAT on the sale or rental of commercial property or in other words to make a taxable supply from what otherwise.

The 20-year rule When you are purchasing a property subject to VAT always ask the seller before the deal if they made their option to tax election with HMRC more than 20. 60 of the gain or loss is taxed at the long-term capital tax rates. In a matter of seconds receive an.

However this is not automatic. Option to Tax. An option to tax cannot normally be revoked until at least 20 years have passed see section 8.

No adjustments are necessary under the capital goods scheme or any outstanding adjustments involve less than 10000 VAT. If you opted to tax more than 20 years ago you can request HMRCs permission to revoke the option under the 20 year rule using VAT Form 1614J as explained in. Use this form if you want to revoke an option to tax land or buildings where more.

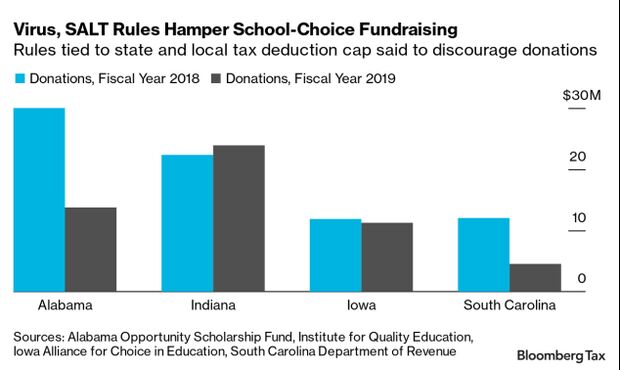

Devos Backed School Choice Groups Hurt By Salt Rules Crackdown Bloomberg Government

Task Force For The Study Of State Tax Credits Economic Incentives Documents Ok Gov Oklahoma Digital Prairie Documents Images And Information

Pdf Dual Income Taxation A Promising Path To Tax Reform For Developing Countries Semantic Scholar

R1 M6 Employee Stock Options Flashcards Quizlet

Page 67 Fy 2020 21 Revenue Outlook

Vat To Basics Finance Services Roger Bennett Tax Function Ppt Download

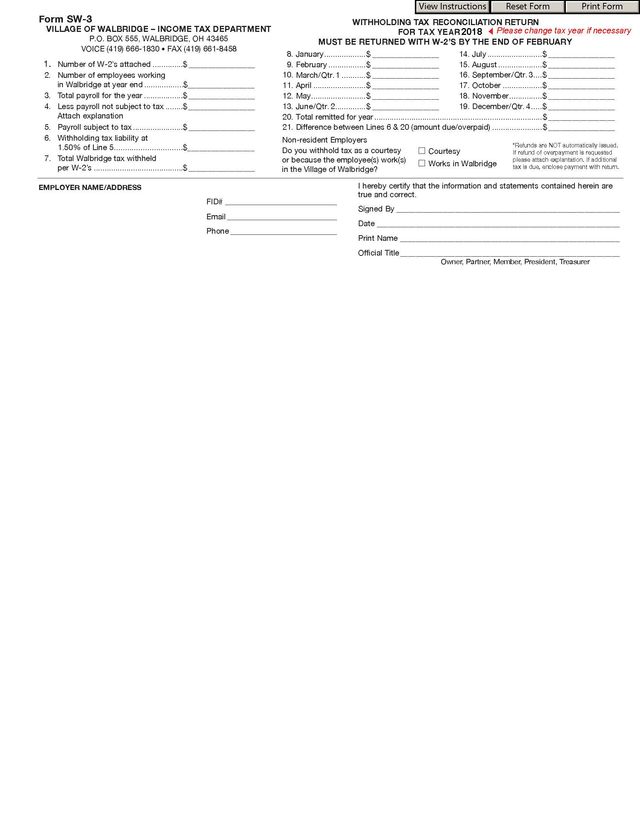

Village Of Walbridge Ohio Tax Forms

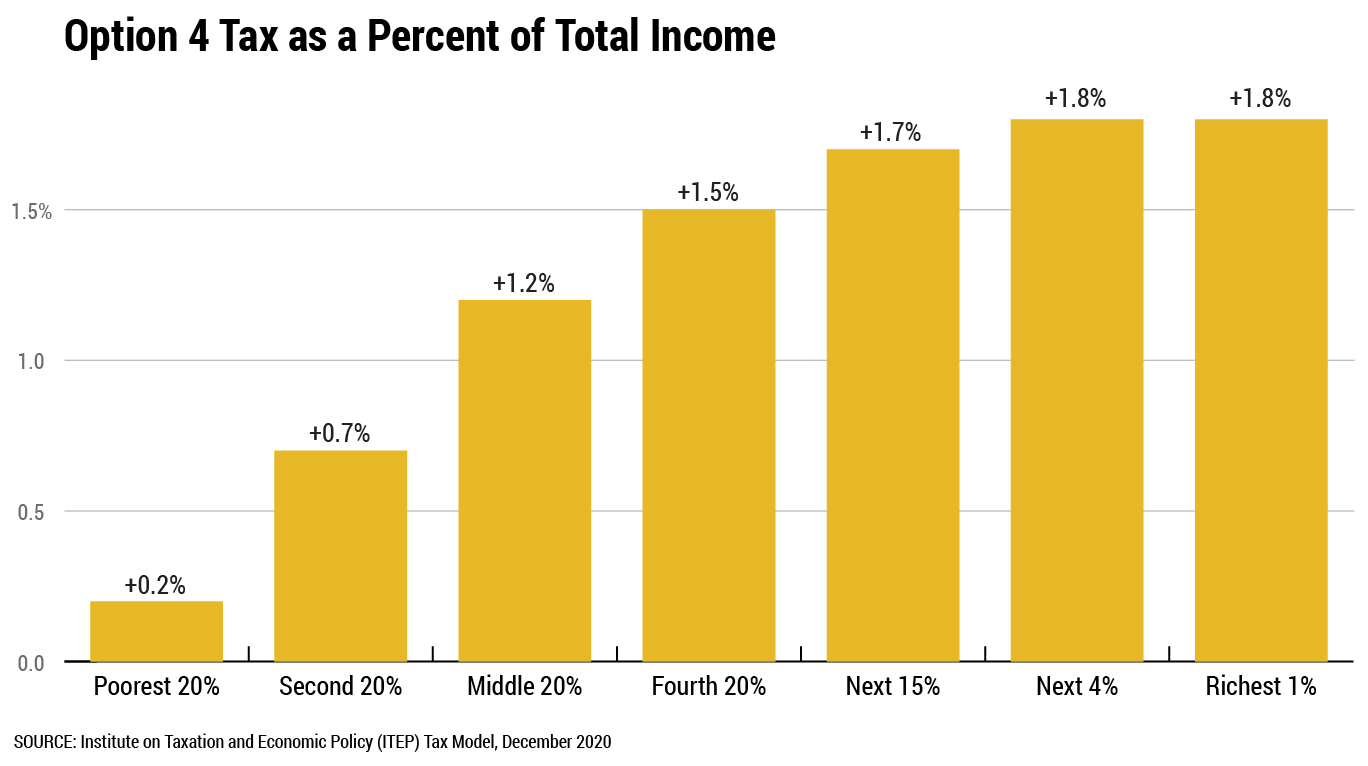

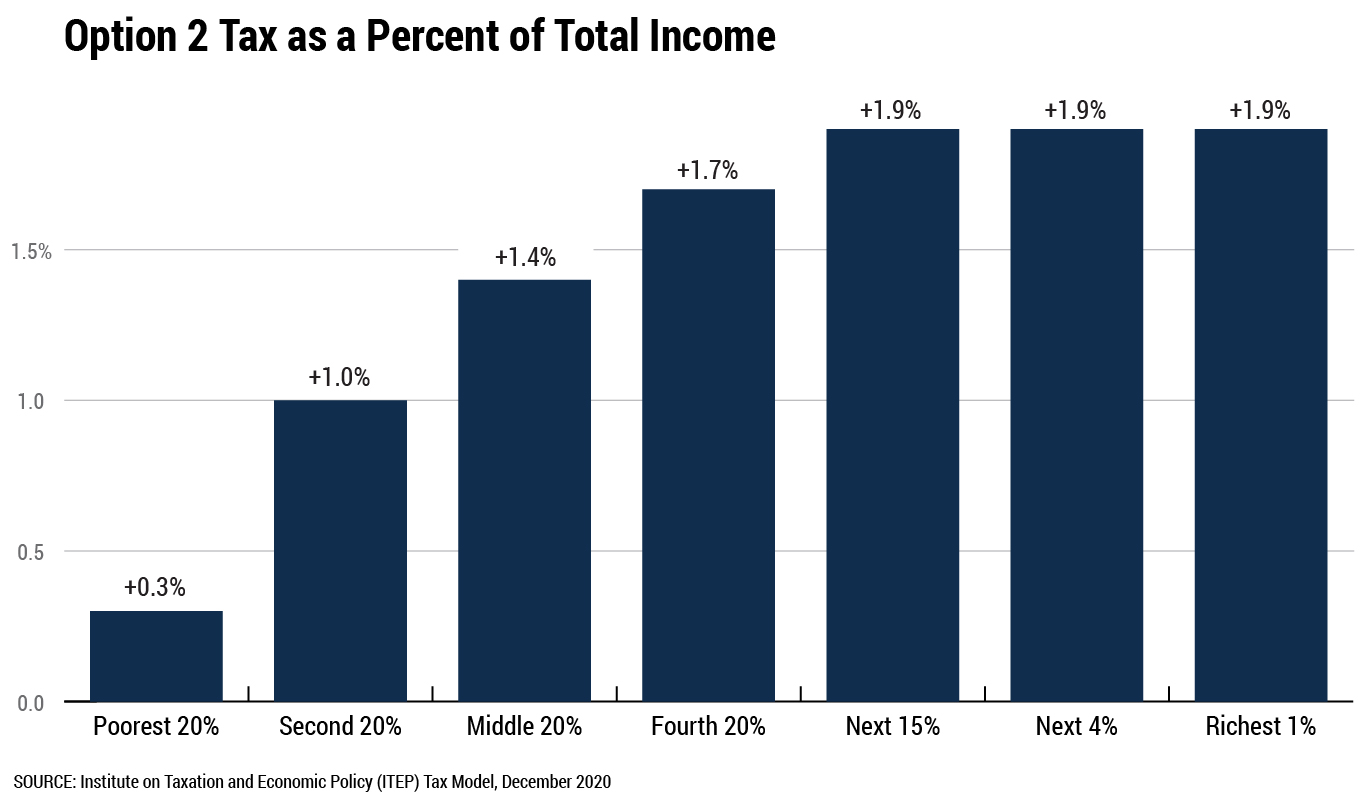

Comparing Flat Rate Income Tax Options For Alaska Itep

:max_bytes(150000):strip_icc()/83bElection-3c7910ebca0d4649be7d880b226ba54e.jpg)

83 B Election Tax Strategy And When And Why To File

Executive Stock Options And Awards Boulaygroup Com

Revoke An Option To Tax After 20 Years Have Passed Gov Uk

A Matter Of Timing Tax Adviser

Old Vs New Tax Regime Which One Should You Choose Forbes Advisor India

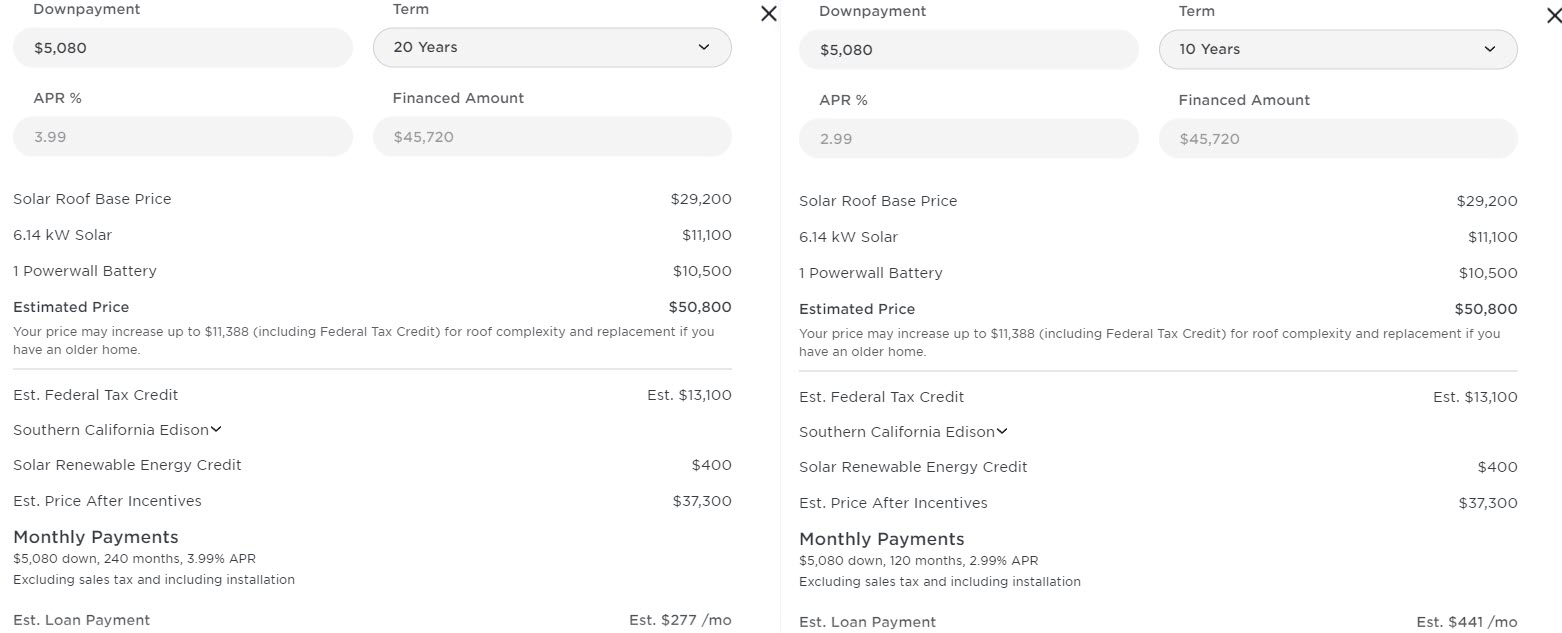

Tesla Re Launches 20 Year Loan Option For Solar Roof Purchases In The Us Tesla Owners Online Forum

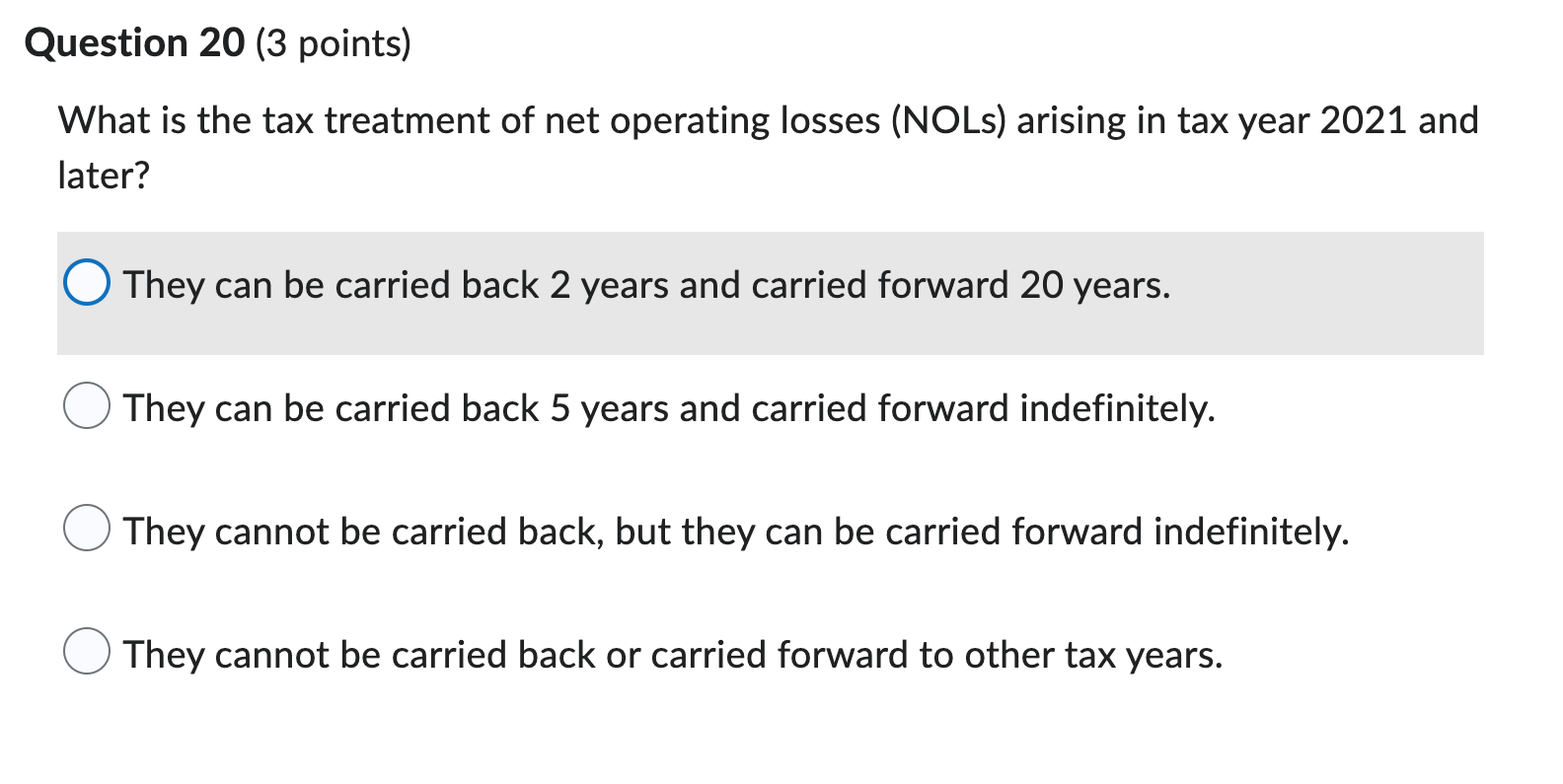

Solved Question 19 3 Points Which Of The Following Chegg Com

:max_bytes(150000):strip_icc()/rothira_final-9ddd537c67fd44ecb14dbdeba58a6ace.jpg)